Registration of companies in Europe

With the development of international relations more and more companies began to seek the way to the global business arena. High-quality standards, more responsible clients, large markets, reliable partners, stable economics, etc. This is just a part of benefits provided by the company formation in Europe. In addition, this option is very prestigious and provides additional opportunities for the organization of profitable activities due to flexible fiscal policy and stable legislation. After you prove yourself and your business legal and reliant you can also receive a residence permit in Europe.

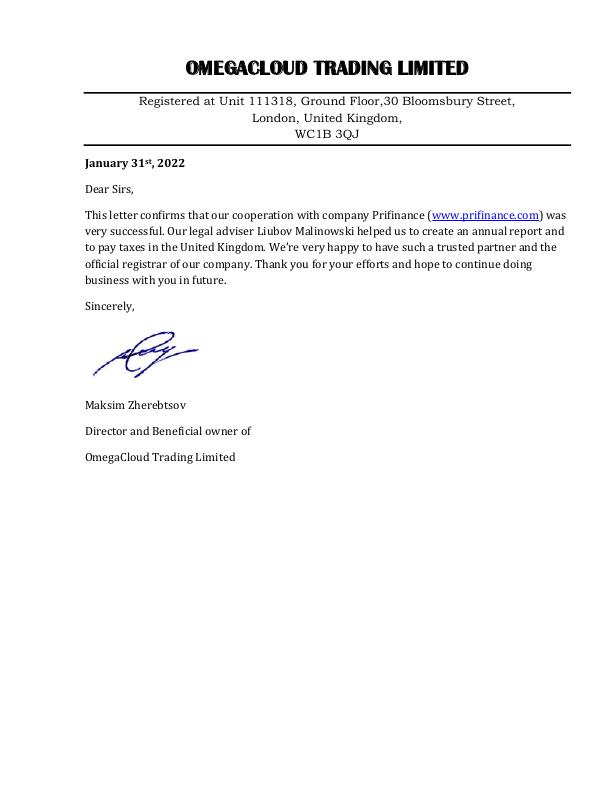

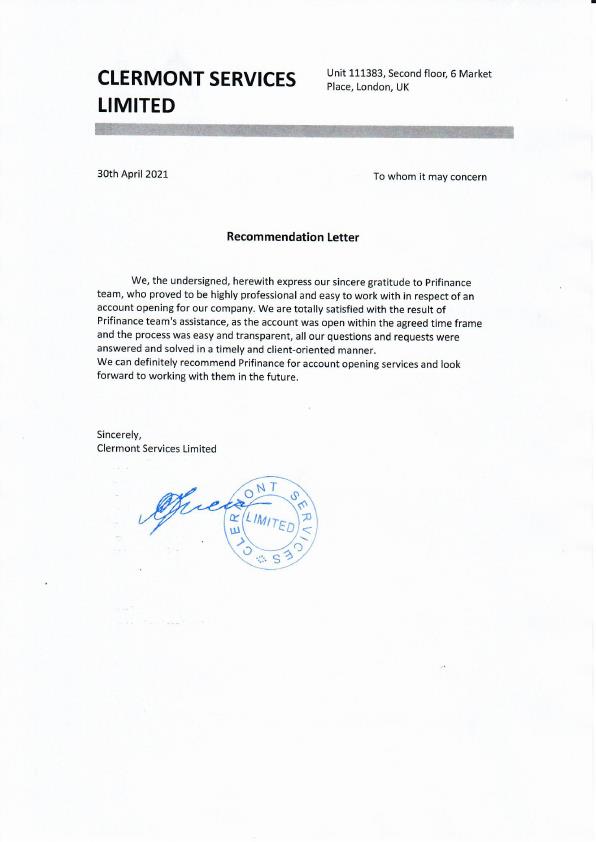

Aotopay specialists provide a full range of services for onshore and registration of companies in Europe. We guarantee our clients the obvious benefits. Among them:

- creation of preconditions for profitable activities if the country has a stable economic and political situation (we pick suitable suggestions for a concrete business case);

- possibility of cooperation with international financial centers;

- minimization of business risks;

- protection of assets and diversification of income sources;

- favorable credit terms;

- avoiding double taxation;

- opportunity of opening corporate accounts in different reportable European banks;

- possibility in the future to obtain a residence permit in Europe.

Gaining these benefits from company incorporation in Europe is possible after clarifying all local details for running a business. Choosing a suitable business structure for this entity with an emphasis on the future types and scope of business activities is a key decision during the company-formation process.

What country to choose

The company "Aotopay" offers a variety of countries for choice. We are ready to register your company in any of them. May it be Switzerland - one of the main financial centers of the world. According to some sources, about a third of global capital is concentrated here. In Switzerland income tax is 8.5%. It is a country with stable economy and developed banking system. In addition to the registration of the company, our specialists will help you to open the bank account.

Or if you register a company in Denmark without goal of making business on its territory, you do not have to pay taxes. It is prestigious location that does not attract much attention of regulatory authorities. Also many companies are located in England. There are no strict requirements for the citizenship of the company director, there is no foreign exchange control and your assets and personal information are protected by law.

There are also many other points to pay attention to, like these most common ones:

- residency of founders and beneficiaries;

- requirements applicable to choosing a business name for a future company;

- minimum and maximum number of company members;

- minimum share capital threshold and possible requirements for paying it up at the moment of incorporation;

- necessity of finding local managers and secretaries;

- liability of shareholders and managers in each jurisdiction and for each considered type of business structure;

- possible demands concerning document management, auditing, and reporting;

- peculiarities concerning the scope of operations allowed to carry out;

- requirements for getting licenses and carrying out regulated types of activities further;

- demands and compliance requirements of reputable European banking institutions.

Aotopay lawyers face the necessity of considering various peculiarities during the provision of legal assistant to our clients in Europe and worldwide. We will also clarify an entirely local applicable legal framework for launching your business project and running it worldwide.

Registering a company in Europe is convenient and reliable from the point of arranging holding structures. Picking nearly any of the European jurisdictions will serve you well for realizing your global business goals. The main point here is which jurisdiction to choose for getting maximum benefits from this legal and business solution.

Which european jurisdiction to choose

There are many factors determining this choice. First of all, your future business goals have to be taken into account while picking the right registration options for a future company. In some jurisdictions, more favorable conditions for financial activities are created while other states encourage manufacturing and service provision more. For instance, Switzerland is one of the main financial centers of the world. According to some sources, about a third of global capital is concentrated here. In Switzerland income tax is 8.5%. It is a country with a stable economy and a developed banking system. In addition to the registration of the company, our specialists will help you to open an offshore bank account.

Another good example is registering a company in Denmark. Having no goals of making business on its territory, you do not have to pay taxes. It is a prestigious location that does not attract much attention from regulatory authorities.

Also, many companies are located in England. There are no strict requirements for the citizenship of the company director, there is no foreign exchange control, and your assets and personal information are protected by law.

How Aotopay specialists may help you

Aotopay offers a variety of countries for choice. We are ready to register your offshore company in any of them and consider all local legal peculiarities and formalities foreign businessmen should follow to increase chances for success.

Our experts may recommend optimal conditions taking into account the specifics of the business and customer preferences, will solve all organizational issues, will carry out the registration of your company abroad, and advise on all matters.

We offer prompt company registration and bank account opening services in Europe and worldwide. New registration and ready-made options. Provide extensive details for more precise consultations and suggestions that can be effective for your future project.