| Country of incorporation | Registration fee | |

|---|---|---|

| Belize | GET AN OFFER

|

1100 USD |

| Costa Rica | GET AN OFFER

|

2300 USD |

| El Salvador | GET AN OFFER

|

1550 EUR |

| Guatemala | GET AN OFFER

|

2500 USD |

| Nicaragua | GET AN OFFER

|

Оn request |

| Panama | GET AN OFFER

|

1780 USD |

Company registration in Central America

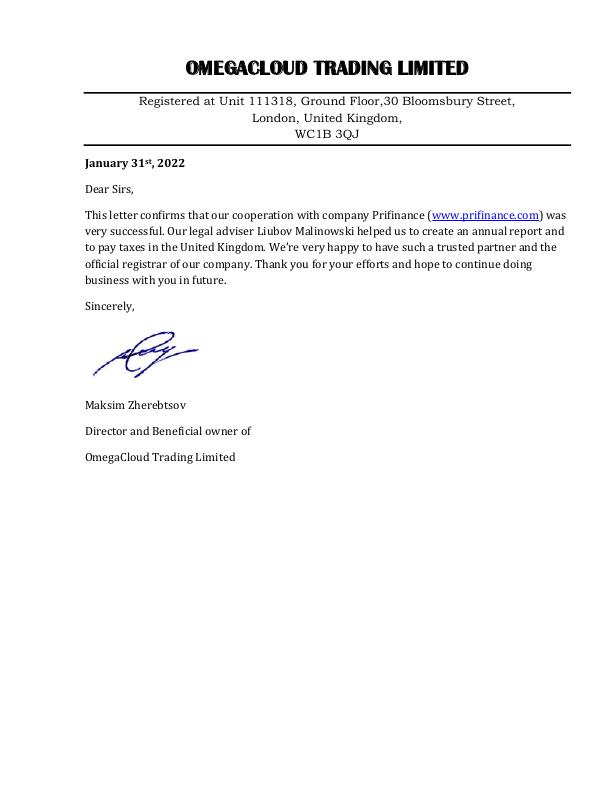

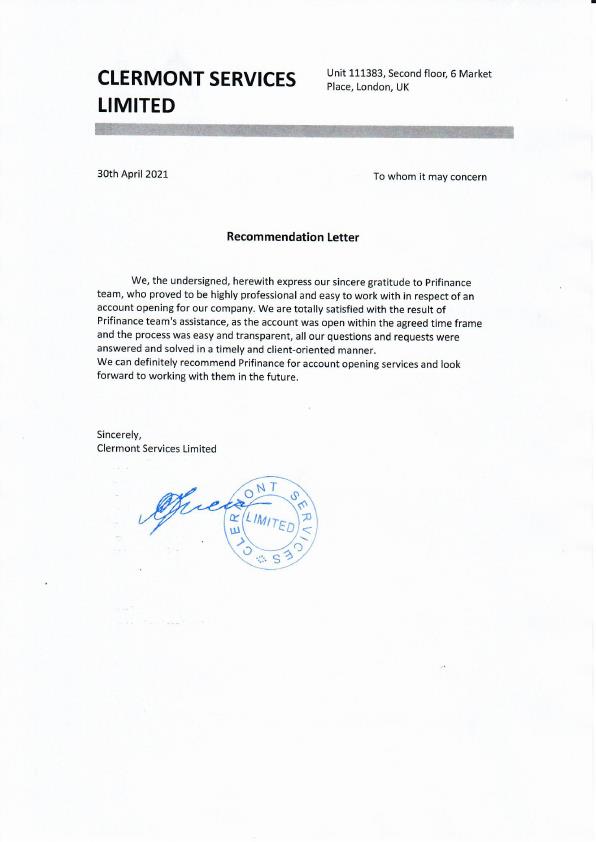

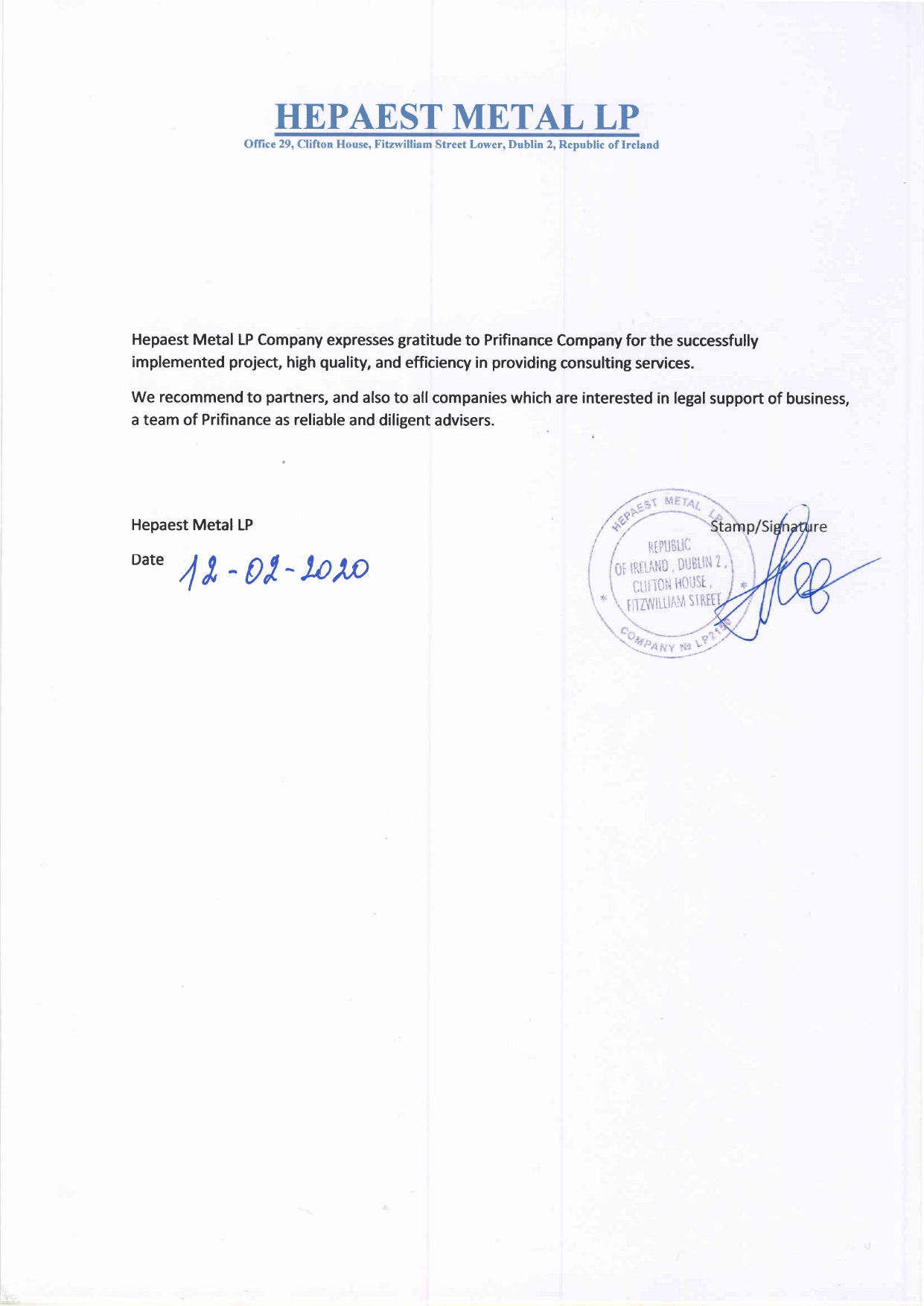

Testimonials

Letters of recommendations

The region of Central America conventionally includes El Salvador, Panama, Belize, Guatemala, Costa Costa Rica, Nicaragua, and other nearby countries. Many of these jurisdictions are interesting in terms of tourism and doing business, primarily because of the following advantages.

Advantages of registering a company in Central America

The decision to open a business in Central America can provide access to the following advantages of the region:

- the simplicity of the process of registration and support of business activities;

- openness and interest in foreign capital;

- opportunity to gain access to minerals (gold, ores, and other resources);

- availability of mechanisms for the protection of assets;

- the possibility of establishing offshore companies in some countries.

Forms of business in Central America

Business registration in Central America is available in one of the following forms:

- A limited liability company is a type of legal entity in which the financial and legal liability of the shareholders is limited solely to the number of contributions to the company. The maximum number of participants in this company is usually specified. It is suitable for small and medium-sized businesses. The legislation restricts the free transfer of company shares to third parties.

- A joint-stock company is designed for larger businesses to attract external financing. A JSC usually has a minimum number of shareholders but no limit on their maximum number. Shareholders are also limited to the number of shares they own. These shares can be freely alienated from third parties and quoted on the stock exchange.

- Branch - an option available to non-resident companies and assumes simple registration without contributing share capital. A branch does not have legal entity status; the parent company is fully responsible for its activities.

- Representative office - an option also available for a foreign company to test the capabilities of local markets and promote its goods/services.

- Offshore - a company that operates outside the jurisdiction of its incorporation, thus being exempt from taxes. The liability of the participants is limited to the limits of their contributions.

Procedure for registering a company in Central America

You can register a company in Central America by following a series of interrelated steps:

- Selection of the most optimal legal form of organization.

- Selection and reservation of a unique name for the future company.

- Drawing up documents on the founders, managers, and beneficiaries.

- Drafting and execution of incorporation documents and registration forms. Filing the package of documents with the registrar and paying the appropriate registration fees.

- Registration for the payment of taxes and mandatory social security contributions.

- Opening corporate bank accounts.

- Obtaining additional permits and licenses.

Regulatory environment and taxation aspects

The region aims to attract foreign investment, which, among other things, manifests itself in a simplified procedure for starting a business and keeping records. Non-residents enjoy equal rights to start a business as residents.

As a rule, the legislation of most Central American countries has no minimum capital requirements for private companies. However, it still has to be formed at a specific size for certain legal forms (e.g., JSC) and companies from certain areas (e.g., financial or banking).

The tax system in each Central American jurisdiction has its particularities. Still, the common types of taxes that businesses must face are corporation tax, personal income tax, VAT, withholding tax, and capital gains tax. If a jurisdiction can register offshore, the tax burden is almost absent. We can talk about a relatively low tax burden on businesses in this region.

How Aotopay lawyers can assist

Suppose the agenda is to open a business in Central America. In that case, the lawyers of Aotopay are ready to help in every possible way its practical realization, including through the following legal services:

- selection of the best options for the purchase or registration of a company in Central America, drawing up a roadmap for the project;

- collecting and preparation of all necessary data for registration of a new company;

- drawing up and executing incorporation documents and registration forms;

- negotiating with local authorities and banks;

- providing comprehensive support to address all issues that may arise during the follow-up of the business in Central America and around the world.

Aotopay lawyers have successfully implemented more than 11,000 projects in the registration field. They will be happy to support the start-up and operation of the business in the new case study.